Accounting is said to be the language of business, as it tells the story of how well your business is doing financially. For this reason, understanding the financial nuances of your construction projects is vital to making operational changes that result in more profit.

Nearly half of all small businesses, however, do not currently employ an accountant or bookkeeper. This is why contractors should strive to build a functional understanding of construction accounting principles; not only because of its practicality but also for the fact that accounting for construction varies quite a bit from traditional accounting practices. A refined understanding of WIP, job costing, IRS requirements, and more is required.

To help you make more profitable decisions and get smarter about financial management, Knowify has put together 5 construction accounting tips and best practices for contractors.

1. Always job cost

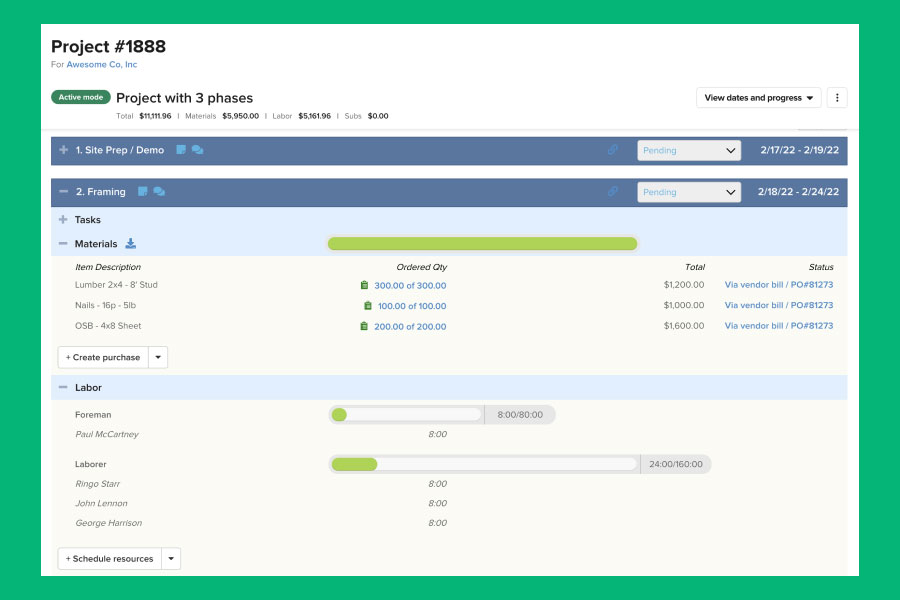

Job costing is an accounting method that tracks all associated costs for a specific job. From an accounting perspective, it takes a single job and treats it as a single account. Job costing identifies how much money you made on a job, provides a clear way to evaluate past jobs, and provides the information needed to gain a better understanding of where and how you make your money. This is done by tracking specific project costs such as equipment and labor costs, materials, and subcontractor costs on a granular level. Because these costs deal specifically with project execution, they are referred to as direct costs.

However, you will want to exclude overhead costs (rent, administrative costs, etc.) and indirect costs from your job costing. It’s recommended that contractors evaluate job costing data before, during, and after every job. For more information on job costing and its advantages reference our Job Costing vs. Process Costing guide

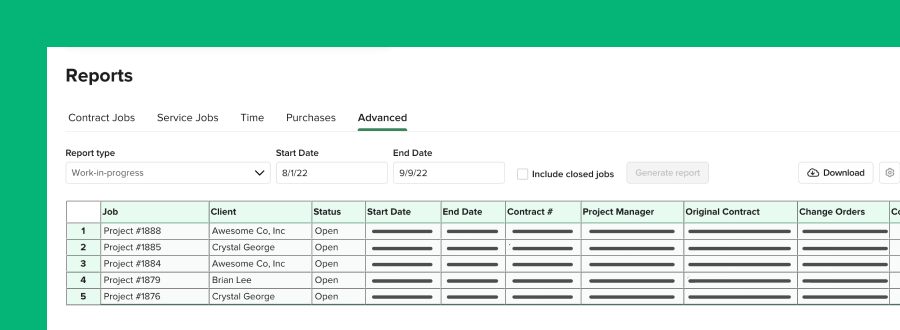

2. Create WIP reports

Work in progress, also known as WIP, is an construction accounting tool used to show how far along you are on a job and how much of the contract value you have earned on a project before you have invoiced your client. From a technical level, WIP is a noncurrent asset account where long-term, fixed assets are tracked. A WIP report helps you understand whether you have over or under-billed for an ongoing job. This is important because over or under-billing can greatly impact reported revenue, which will affect your numbers come tax time.

Job costing accuracy is essential for boosting the profitability of existing jobs, creating more accurate bids for future jobs, and for adapting your suppliers and labor costs to increase profits over time. As a result, WIP reports are a powerful tool for fostering precision with your numbers. For a deeper look at WIP and its impact on accounting for construction check out our article on “Everything you need to know about WIP”.

3. Use the right accounting method

Accounting for construction companies is more specialized than most industries and requires unique reporting methods that need to be in compliance with distinct IRS regulations. There are three distinct accounting methods for construction accounting: Cash, percentage of completion, and completion of contract. Each has its own advantages and scenarios in which it is best used.

Cash

The cash method is straightforward and relatively simple. Revenue is recognized when cash is collected and expensed when cash is spent. The difference between cash in and cash out will determine your income or losses. This means that there are no accounts payable or accounts receivable as a transaction does not exist if money didn’t physically change hands under cash accounting. Although cash accounting is flexible and accessible, you must fit certain criteria set out by the IRS in order to use this method. To be eligible for the cash method the IRS states that your construction company must have less than $25 million in gross receipts (over a three-year period).

Percentage of completion method

The percentage of completion method is amongst the most common in the construction industry and works by recognizing revenue and expenses over time, often as the project progresses and a designated percentage of work completed. This method should be used if revenues and costs of a project can be accurately estimated and all parties involved are expected to be able to complete all of their respective duties.

As a result, the IRS typically requires that contractors use percentage of completion for long-term projects. Although home construction projects and small business contractors are often exempt if the size of the project and the size of the contractor are within their defined limits. They define small contracts as any project to be completed within two years and define a small contractor as having $25 million in gross receipts (over a three-year period).

Completed contract

Under the completed contract method, you recognize revenue or expenses only when the project is completed or substantially completed. Once the project is completed all accumulated accrued revenue and expenses will be recognized on the income statement. This method is great for short-term projects but will not be tax-compliant for long-term projects. If using this method contractors should use a separate balance sheet to record revenue and expenses.

4. Know your state’s compliance laws

It’s absolutely essential that construction companies have an intimate understanding of their local and state laws and requirements. Wherever you are bidding and working you need to know the laws around construction contracts and their requirements, building codes, insurance, licenses, union payroll agreements, prevailing wage requirements, safety regulations, and lien rights. Do your due diligence as a business owner and take the time to understand these requirements verbatim.

5. Utilize software

Navigating accounting for a construction project can often seem like a daunting and time-consuming task; spreadsheets and manila folders will only go so far. Fortunately, there are tools available for construction firms that can simplify life and radically improve business processes. Utilizing digital tools can eliminate virtually all of the headache caused by manual bookkeeping. The right software will help your team collect project data as they work, so you don’t need to spend time finding information and re-entering it into your accounting system.

For growing businesses in the construction space, our recommendation is Quickbooks Online Advanced. Simple-to-use cloud-based accounting software like Quickbooks Online, along with a cloud-based project management solution, helps keep all of your financial data up-to-date and organized. When the numbers are crunched for you, you can spend more time focusing on your team and trade. The value of digitizing your business cannot be overstated.

Conclusion

No matter your trade, financial and accounting education is vital to ensuring your construction business stays healthy and profitable. One thing that is undeniable is the importance of accurately tracking your numbers and evaluating those numbers to make better decisions. Use the right accounting method for your construction projects and be sure to job cost every job every time.

As a contractor, you more than anyone, know the importance of having the right specialist for the right job. You wouldn’t have a carpenter rewire your house and you wouldn’t have a painter fix your plumbing. Never shy away from seeking help from those who are masters at their craft. Although you should strive to know much as you can about these principles, seek out help from construction accountants, advisors, and experts in bookkeeping and financial management and know that you are putting yourself in good hands.

Looking to stay one step ahead of market changes?

Many contractors are looking for new ways to adapt to rising fuel and material costs – so what can your contractor business do to adjust? We put together a quick guide with 4 tips you can use to fight back against rising costs, and increase your profit margin.

From tips on developing more accurate quotes, to ideas for managing your projects and improving customer satisfaction, use this guide to grow a healthier and more profitable business.