Knowify vs. Buildertrend

Both Knowify and Buildertrend are construction project management systems that offer a variety of tools to improve project workflows. But which is best for your specific business needs? To help you find the right software this article will break down…

Knowify news

Stay in the know by reading our blog; find relevant information on best practices in the industry and how to run and grow a construction business efficiently.

Tracking WIP: Knowify vs. QuickBooks Online

In the fast-paced world of construction project management and construction accounting, understandin…

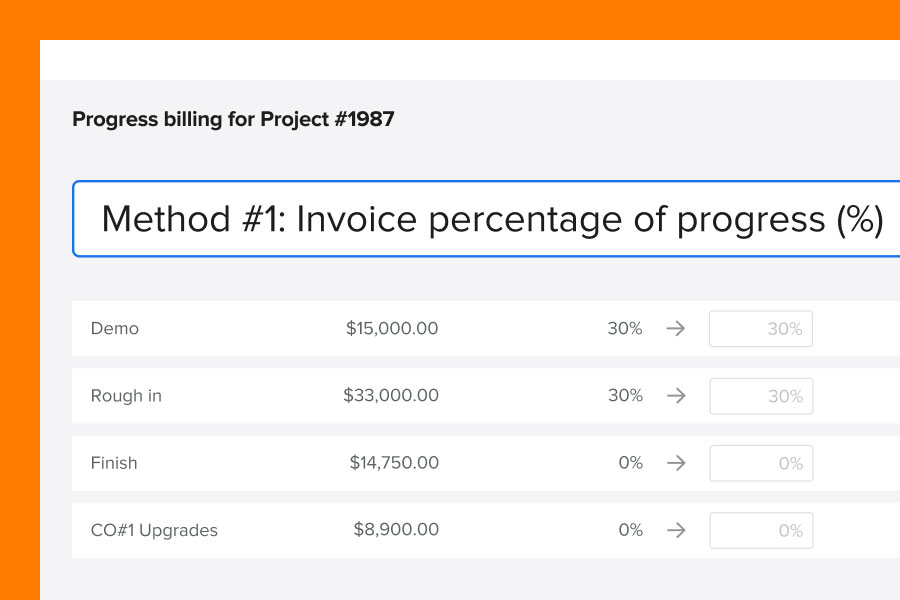

Comparing Knowify’s contractor-centric approach to progress invoicing with QuickBooks Online

For all but the simplest construction projects, progress invoicing is the go-to invoicing style for …

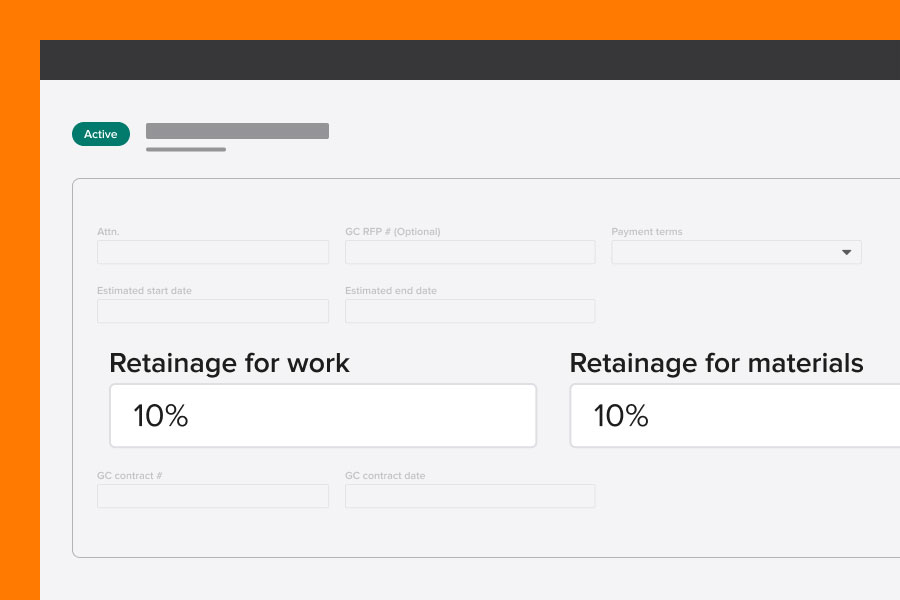

Managing retainage: Using Knowify to fill the gaps in QuickBooks Online

If you do commercial work, retainage is a fact of life. And if you’re like many trade contractors, y…

Knowify vs. Buildertrend

Both Knowify and Buildertrend are construction project management systems that offer a variety of to…

Transform your contracting business (and your life) using SOPs

Do you feel like you’re trying to outwork a dysfunctional business? Drowned by demoralizing waves of…

Electrical contractor software buyer’s guide: Find the perfect tool for your business

Success in the electrical trades requires a combination of intelligence and hard work, but this alon…

3 reasons why your next construction project should start with a budget

Are you doing great work for happy customers, but finding that you still aren’t making money? …

Making a construction schedule: Construction scheduling basics

In the construction industry, one of the biggest challenges is ensuring everything and everyone is i…

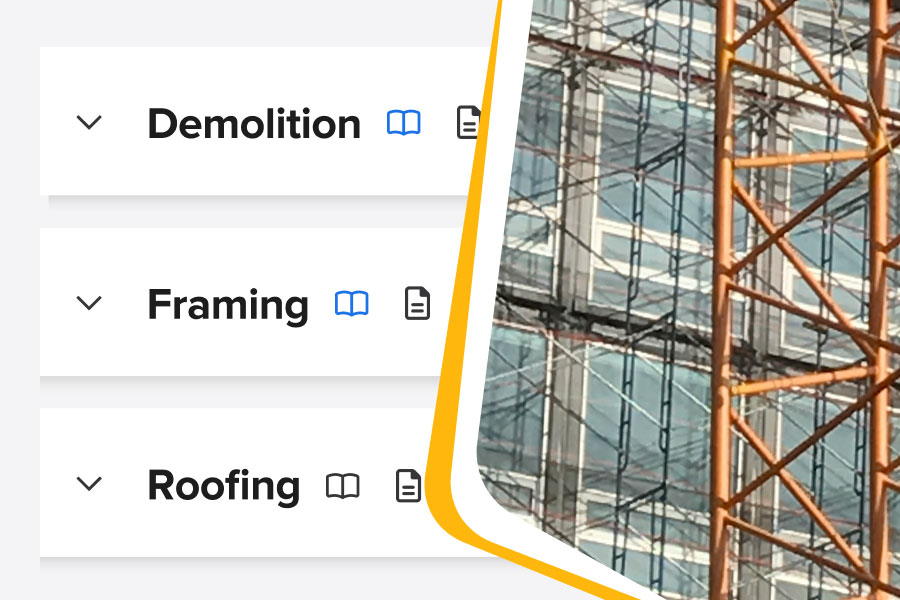

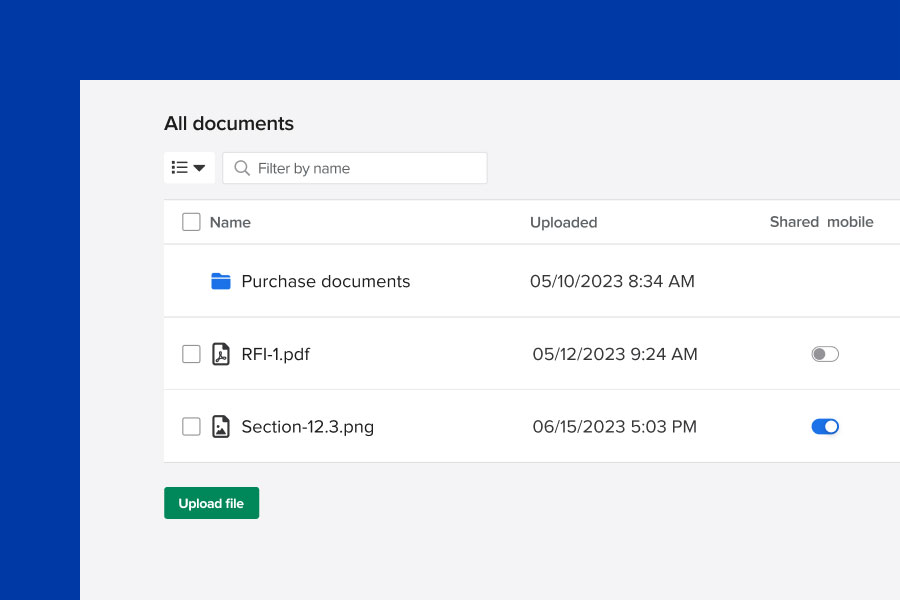

Construction document management: How to streamline your projects

Construction document management is a process for organizing, storing, and facilitating all relevant…

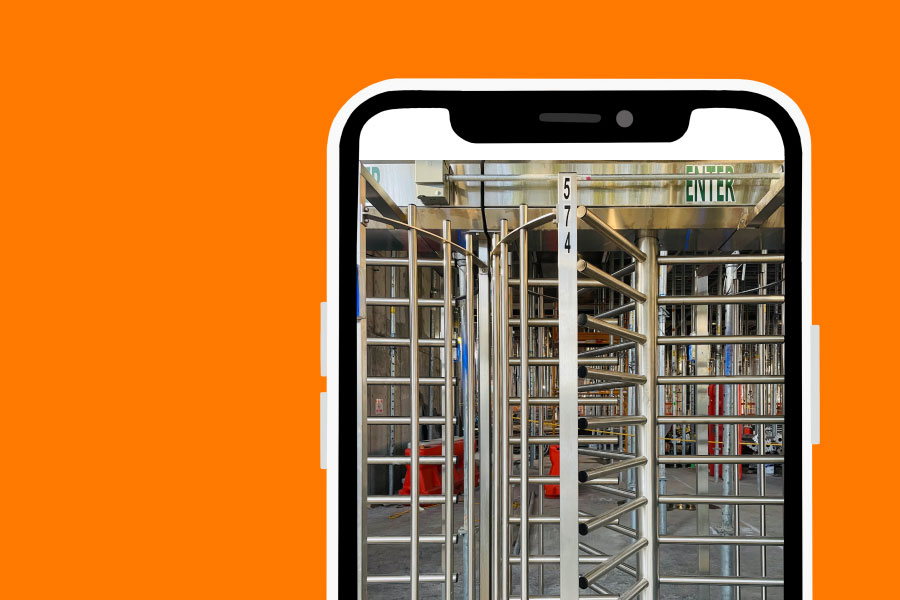

How to use software to simplify labor management

Experienced contractors are more likely to finish projects on-schedule and under-budget with a relia…

5 ways to get your team on board with new software

Experts say it takes about 2 months to form a new habit. When it comes to implementing new technolog…

5 ways to beat the heat on jobsites this summer

Lucky for us over at Knowify, we get to stay indoors in a cool, air conditioned space. We know, howe…

New York Build

New York is hosting one of the largest construction and design events in the city next week: New Yor…

World of Concrete 2023

Concrete results you’ll see all year. World of Concrete 2023 starts its educational track toda…

ABC tech report: what contractors need to know

Released in September of 2022, the Associated Builders and Contractors released its latest tech repo…

Product updates

Stay up to date on the latest Knowify product news. Here we’ll share detailed information from our product team about new features, improvements, and more. Check back often to avoid missing anything.

Subscribe to our latest news

Subscribe today for the latest from the Knowify blog! Stay in the know by reading our posts and never miss the trends in the construction industry.

** Knowify needs the contact information you provide to us to contact you about our products and services. You may unsubscribe from these communications at any time. For information on how to unsubscribe, as well as our privacy practices and commitment to protecting your privacy, please review our Privacy Policy.