A recent article in Accounting Today looked at how some accounting firms are adding payroll services to bring added value to their clients while also distinguishing themselves from their competition. The article also noted that as “the market for customizable payroll solutions is expanding,” some firms are even spinning off entire practices just to meet client payroll-related needs.

What the article fails to mention is that accounting firms that limit their offerings to payroll alone, leave money on the table and the door open to a savvier competitor who’s also providing clients with business management systems.

Really… leaving money on the table?

Yes, by thinking small. Think BIG picture instead.

Are you just accountants, running numbers, filing taxes, doing audits? Or are you (as an increasing number of firms are) consultants, advising clients on how to run and grow their businesses faster, smarter, and cost-efficiently.

If you’re the latter, then you know that managing client payrolls yourself, or recommending an outsourced provider or software solution alone doesn’t cut it. When you know your clients are already stretched in the day-to-day management of their businesses, when they are busy selling, bidding, executing, managing people and projects, invoicing, and collecting again and again and again… setting them up with a payroll solution is like giving them a paper umbrella to face a tsunami. It’s a band-aid solution to a more serious problem—business mismanagement.

Be a hero

Discussing how to help clients, who issue paper checks to pay employees and vendors, type invoices, lick stamps, and run operations on Post-its, scraps of paper or spreadsheets, requires a longer conversation. Cutting to the chase, there are plenty of excellent accounting packages you can introduce them to, so shame on you if you haven’t done so already.

But let’s say you have introduced them to QuickBooks or some equivalent bookkeeping solution, why stop there? Accountants who teach clients to really manage their businesses improve their own client retention. Switching a business owner from spreadsheets to an accounting package is just the beginning.

Automate client businesses, not just their payroll

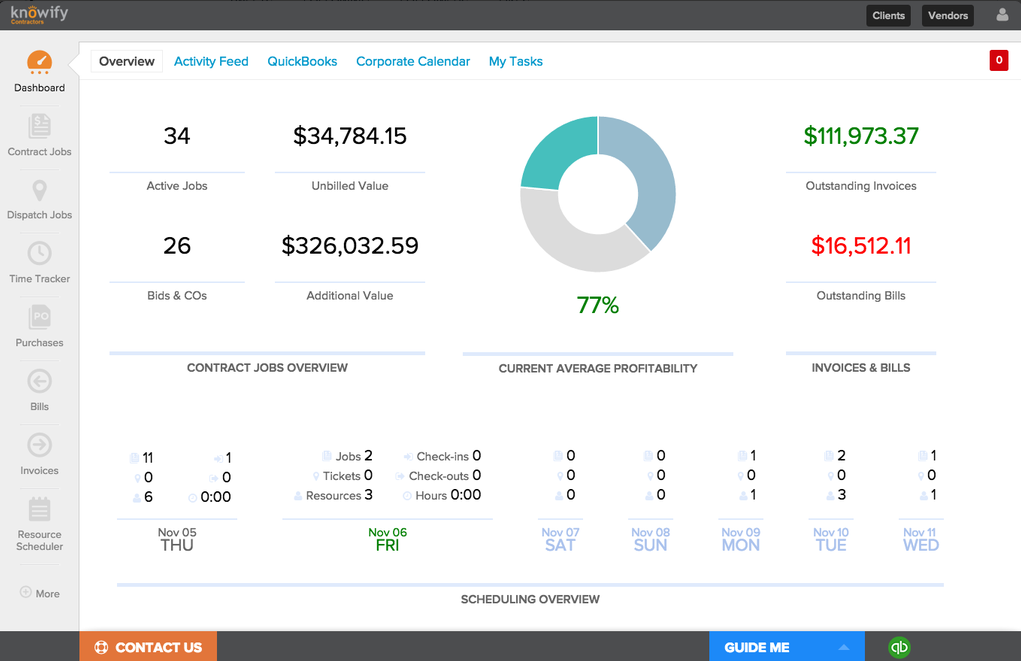

Increasingly, accounting firms are looking to help, for example, their building trades clients (really, all clients) move beyond conventional payroll or other business accounting software to equally affordable, easy-to-use, cloud-based or desktop systems to manage most of their typical (and repeating) business management processes.

This is a win/win for all parties

Client businesses run more smoothly. And you spend less time sorting through bags of receipts, or stacks of timecards and more time advising clients on best practices/management strategies.

Invite clients into the 21st century

Show them you care. As you did long ago with accounting software, show them how to replace the spreadsheet and whiteboard with something better. Expose them to the right tools. Help them see that they can efficiently and cost-effectively, and profitably manage and grow their businesses from any smart device—whether they are in the office or in the field.

Be that advisor. Knowify, for one, can help you help them. We’re already doing it. If you have any questions or wish to share your feedback, you can find us at support@knowify.com.

Ask us about how we’ve helped accountants like you help their clients get a better handle on their business. Or… you can let them keep running their businesses on spreadsheets.

Knowify. Built for the real world.