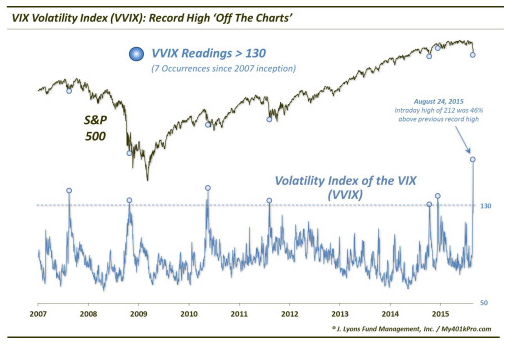

If you’ve been looking at the recent volatility in the stock market—which has been all over the news—you might worry that tough times are on the horizon.

Cyclicality is one of the hallmarks of the construction business

If you’ve been around a while, you know that keeping an eye out for coming slowdowns is an important part of maintaining a healthy, and profitable business. So… does the drop in the S&P500 mean that the US economy (and the construction business) is about to follow suit?

It’s always hard to predict anything with certainty about the US macro-economy, but the data points that have the strongest connection to future construction activity say that it’s not quite time to worry (yet).

As reported:

- Building permits for work not yet started were up 7.5% year-over-year in July;

- Mortgage financing remains widely available, and—critically—interest rates are low (around 4% on national indices) and remaining steady;

- The tough economic news coming out of China, the epicenter of the recent worldwide market turmoil, may actually benefit American builders;

- Critical materials like steel or copper wiring should continue to get cheaper as the world’s top consumer (China, by an enormous margin) sees its consumption decline from truly astronomical levels; and

- Big institutional US investors are increasingly turning to “safer” cash flow yielding domestic assets like commercial property to protect their clients from the risk we’re seeing in global equity markets.

What does that mean for contractors?

Could be good news. As long as interest rates stay where they are, and financing remains available, construction activity will have a tailwind behind it.

Low interest rates increase property values, make HELOC-funded renovations more affordable, and income-yielding investments like rental properties and commercial buildings more attractive. If interest rates begin to rise, this tailwind could swiftly turn into a headwind. Be prepared. Be efficient. Be profitable.

So, don’t freeze like a deer in the headlights. Regardless of what happens in the market, those who survive and thrive during times of turmoil are the contractors who pay attention to running their businesses… who monitor jobs and profitability… who keep the lines of communication open between their GCs, subs, and clients.

Information is power

During an uptick or a downturn, make sure you have the processes and procedures in place to run your business. If you have any questions or wish to share your feedback, you can find us at support@knowify.com.

Ask me about how we’ve helped other contractors like you get a handle on their business Bull Market or Bear Market. Or… you could keep running your business on Excel spreadsheets.

Knowify. Built for the real world.