Demystifying construction accounting for contractors

A practical guide to mastering the fundamentals of construction accounting. From identifying hidden costs to cash flow strategies to setting financial goals, learn how to build a better financial future for your business.

Making construction accounting accessible for contractors

Construction accounting has unique requirements and complexities that demand specialized skills and knowledge.

It’s a far cry from the ordinary accounting of almost every other industry. It takes grit, dedication, and a little bit of know-how to get finances where they need to be.

To reach the level of financial success you seek, you must master the foundations of construction accounting- its principles, guidelines, methods, and more.

With this guide, you can take the first steps towards financial independence by understanding the systems and methods that dominate construction accounting.

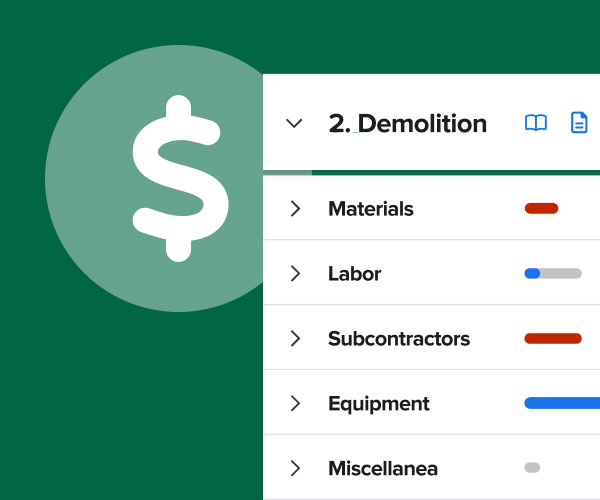

Identifying indirect costs in construction

Discover how to identify and manage indirect costs in your construction business, and when to allocate them to your jobs for job costing purposes.

What you’ll learn

- What an indirect cost is and how it contributes to profitability

- The importance of labor burden

- How to account for material procurement and equipment costs

- The advantages of using digital tools over manual processes

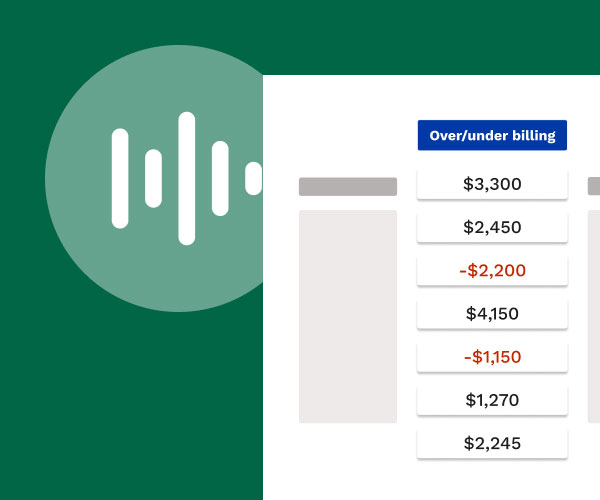

Improving cash flow management

Explore why cash flow is central to financial stability. Learn how to use cash strategically instead of reactively with our 6 cash flow management tips for construction contractors.

What you’ll learn

- Uses of cash in construction

- What problems can be solved with better cash flow management

- The importance of operational budgets

- Strategies for job costing

- How to negotiate favorable terms

- How to leverage credit responsibly

- When to seek financial advice

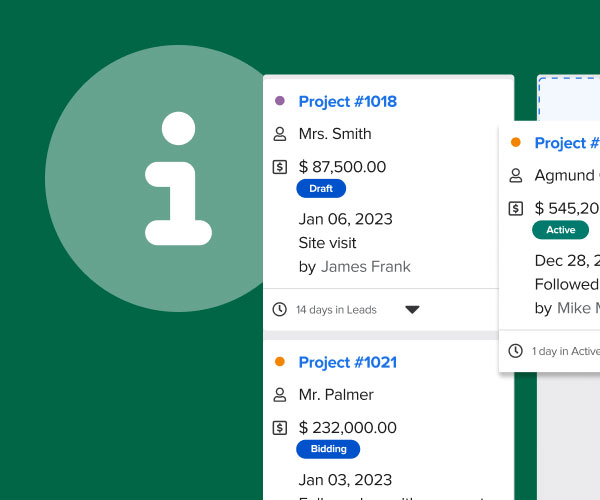

Digital tools and resources for contractors

Dive into the essential tools and resources currently available for construction professionals. Learn how to leverage technology to elevate your performance and stay ahead of the game.

What you’ll learn

- The impact of technology use on job performance

- Project management tools

- Accounting and bookkeeping tools

- Payroll tools

- Data security best practices

Financial statements

Discover how to interpret and utilize income statements, balance sheets, and cash flow statements to make better decisions for long-term growth.

What you’ll learn

- How to read financial statements to gain an accurate snapshot of your business’s financial health

- A breakdown of the three most important financial statements: income statement, balance sheet, cash flow statement

- How to identify trends and make informed decisions based on financial statements

- The importance of financial statements for securing financing and remaining GAAP-compliant

Retainage

Learn how retainage impacts cash flow and what you can do to better handle retainage contracts with confidence.

What you’ll learn

- Strategies for handling retainage in construction contracts

- The impact of retainage on cash flow and how to manage it

- Ways to minimize the negative effects of retainage and how to negotiate better contract terms

Milestone vs. Progress billing

Discover how to effectively manage billing and revenue recognition in the construction industry using the two most common methods: milestone and progress billing.

What you’ll learn

- The differences between milestone billing and progress billing

- The advantages and disadvantages of milestone and progress billing

- How to overcome financial challenges caused by late payments

Understanding the percentage of completion method

A deep dive into the percentage of completion method for revenue recognition in construction. Learn how it works, how to calculate it, and how it impacts cash flow management.

What you’ll learn

- What the percentage of completion method is, and how it functions

- Its importance in the construction industry

- How to calculate percentage of completion using three different methods

- Potential risks and challenges with using the percentage of completion method

Construction accounting methods 101

Gain a comprehensive understanding of cash basis and accrual construction accounting and how they can benefit your business–from GAAP compliance to how to effectively recognize revenue.

What you’ll learn

- Learn about the unique challenges and specialized skills required in construction accounting compared to traditional accounting

- Gain an understanding of the four most common methods: cash basis, accrual accounting, percentage of completion, and completed contract

- Key differences and pros and cons of each method, including their impact on job costing, cash flow, and financial reporting

- The importance of GAAP (Generally Accepted Accounting Principles)

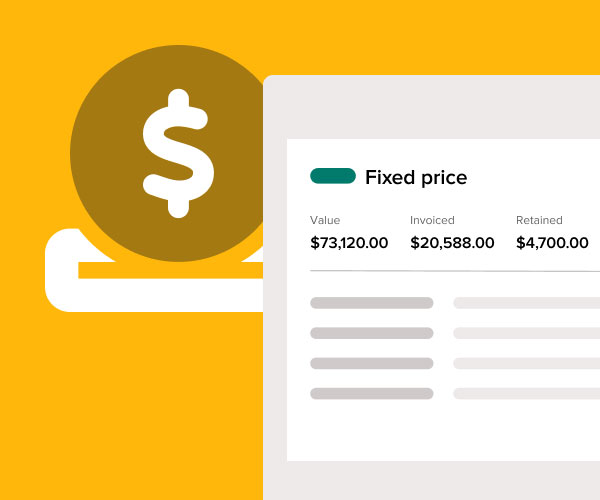

5 construction billing methods

Learn about the advantages and disadvantages of fixed price, cost-plus (T&M), unit price, and AIA-style progress billing methods.

What you’ll learn

- The advantages and disadvantages of each method

- When to use each method

- How each method impacts job costing

Understanding chart of accounts

Discover the key steps to creating an effective chart of accounts. Learn how an effective chart of accounts can provide invaluable insights into the financial health and growth potential of your business.

What you’ll learn

- Learn how to organize and interpret financial statements to fully understand your business performance and financial health

- Discover the importance of a chart of accounts in providing accuracy and structure for every business transaction

- Understand the different types and categories of accounts that make up a chart of accounts for a construction company

- Gain valuable knowledge and tips on structuring and managing a chart of accounts from industry experts

Setting financial goals for construction contractors

We spoke with Tonya Schulte, construction accounting guru and founder of The Profit Constructors, to detail exactly how contractors can set big yet achievable financial goals.

Learn how to make finances a priority, how to avoid common financial pitfalls, and how to set and track financial goals.

Glossary of construction accounting terms

Broadening financial knowledge is essential for any business owner. Understanding the key terms and concepts of construction accounting is a great place to start.

We’ve listed and defined the most important financial terms and concepts to strengthen both financial literacy and business acumen for contractors.

Asset

An asset is any resource with economic value owned or controlled by you. Assets can be either tangible (physical things like equipment) or intangible (non-physical things like your brand value or customer list).

In construction, assets are often physical items such as equipment, tools, and various materials used to perform jobs or services. Assets provide contractors with the resources needed to perform work.

Liability

On the other side of a balance sheet, opposite assets, liabilities reflect any legal responsibility to pay debts or fulfill contractual obligations; liabilities may include loans, accounts payable, bonds, deferred revenues, or other accrued expenses.

Contractors will commonly see liabilities in the form of accrued labor costs and accounts payable owed for materials. Another common one is customer deposits. When a customer provides a deposit (or a downpayment) at the beginning of the job, the contractor owes them work to earn that deposit/downpayment.

Cash

Cash is legal tender used to exchange goods or services. Any assets that can be easily converted to cash (like overnight money-market funds) can also be considered “cash” from a financial perspective.

Cash is an integral component of managing a healthy business. It provides contractors the necessary funds to purchase materials, hire workers, and cover miscellaneous job expenses.

Construction Bond

A construction bond is a surety bond typically used to protect building owners. Given that a contractor’s inability to perform can result in significant delays (and therefore costs) to a project, a construction bond pays the owner if the if the bondholder (the contractor) triggers its provisions. Construction bonds are usually only seen on large projects or government projects.

Capital

Capital is anything that holds or can generate value; capital could be equipment/machinery, intellectual property, or financial assets. Any money or assets used to produce goods and services, or to fund investments, can also be defined as capital.

Access to capital is essential for contractors to take on more jobs, hire more employees, and grow as a business. While money on its own is considered capital, as it can be used to purchase materials, equipment, and labor, there are many forms of capital that contractors should be aware of:

- Debt capital – Any funding acquired through borrowing.

- Equity capital – Funding acquired through the sale of ownership in the company (usually in form of shares of common or preferred stock).

Accounts payable

Accounts Payable, or A/P, describes money owed by one company to another for invoices that have been properly presented for payment. A/P is recorded on the balance sheet as a liability.

Accounts payable is a list of all the money owed to vendors or suppliers. When contractors purchase materials, higher subcontractors, or rent equipment, they must record these expenses into an A/P system. Negotiating longer payment terms with your vendors can be one way to manage your cash flow, if they’ll agree to it.

Accounts receivable

Accounts Receivable, or A/R, is money owed to a company by its customers for invoices that have been properly presented for payment. On a balance sheet, A/R is reflected as an asset.

Staying on top of accounts receivable is an essential part of managing the cash flow of a construction business. Good A/R management has two pillars: (1) timely invoicing (according to the terms of a contract); and (2) diligent, but not pushy, collections. For (1), you need to make sure you’re sending out your invoices on time and not missing invoicing cycles (especially on larger jobs that only permit one invoice per month!); for (2), you want to press your customers to pay according to the terms they’ve negotiated. If you let your customers get away with paying you slowly, you’re hurting the cash flow of your business! One last thing to remember: receivables are an asset for your company; if you find yourself in a cash-crunch, there are many companies that will allow you to borrow against your receivables, or sell them outright at a discount.

Credit

Credit is the ability to access or borrow money, and in turn, take on debt, with the obligation to pay it back. Lenders, vendors, merchants, and service providers can all serve as creditors, granting credit to borrowers they determine capable of repayment.

The construction industry heavily relies on credit throughout the entire payment chain. Contractors utilize credit to finance projects they could not afford otherwise; it can be used to purchase materials, services, labor, or equipment required to complete a job. Building strong credit can go a long way in securing better payment terms with your vendors, better financing terms from banks or other partners, and lower premiums for certain types of insurance.

Generally Accepted Accounting Principles (GAAP)

Generally accepted accounting principles are standards and guidelines created by the Financial Accounting Standards Board. They are the basis for all accrual-based financial statements in the U.S.; all public companies in the United States are obligated to follow GAAP. GAAP aims to ensure consistency in accounting practices and financial reporting through a standard set of rules, procedures, and practices.

Job costing

Job costing is an accounting approach for allocating all the associated costs for a job to that job. The goal of job costing is to determine job-level (and even sometimes phase-level) profitability.

Job costing is essential for any contractor looking to understand job-level profitability. Reference our Guide to Job Costing for a complete breakdown.

Income statement

Also referred to as a P&L, an income statement or profit and loss statement consolidates revenues, costs, and expenses generated for a specific period of time; many income statements will display numbers for a quarter or fiscal year and are used to measure the financial success of business operations. Most income statements are presented on an accrual basis, which means that revenue is only recognized when earned and costs are matched to the associated revenue. Be careful though: while an essential accounting tool, an income statement won’t tell you how much cash your bank account increased or decreased by in a given period – cash flow can be impacted by items not reflected on an income statement!

Contractors can use income statements to reveal crucial insights into the financial performance of their business This information can be used to help plan and budget for the future of the business.

Accrual accounting

Under accrual accounting, revenue is recorded when earned, not when the company collects the money. Likewise, costs are only recognized in the period when the associated revenue is recognized.

For contractors, accrual accounting will mean recording income when a job is completed, even if the project owner or client has not paid the invoice. Expenses will also be recorded when the service or goods are received, even if the contractor hasn’t yet paid. Why do this? Accrual accounting can be used to reflect the true financial performance of a business without waiting for all payments to be received.

Profit

Profit is defined as total revenue less total expenses. However, profit can be calculated and reported in various forms, such as:

- Gross profit (profit made after subtracting the direct costs associated with providing a good or service (aka, Cost Of Goods Sold, or COGS)

- Operating profit (Operating Profit = Gross Profit – Operating Expenses)

- Net profit (Operating Profit less interest and taxes, commonly referred as “bottom line”)

Profit margin

At a basic level, profit margin is operating or net profit (depending on the case) divided by revenue; profit margin will display how many cents of profit is made per each dollar of revenue.

Profit margin is a key indicator used by creditors, potential partners, and investors to measure the financial health of a business. Internally contractors can use profit margin to understand profitability, efficiency, and areas of improvement.

Markup

Markup is the additional amount of money added to the price of goods and services above the costs to the company for delivering those goods or services. It’s the gross profit you expect to earn.

Contractors commonly use markup to ensure profitability. Typically expressed as a percentage, markup is applied to either individual or aggregated (like a line item or a project total) costs, increasing the final price quoted to a client.

Overhead

Overhead costs consist of any expenses that must be paid to keep a business up and running that are not directly related to the production of a good or service; these costs include rent, property tax, insurance, and licenses.

Contingency funds

A contingency fund is a lump sum of money set aside for unforeseen costs that may arise during a construction project.

A form of risk management, contingency funds can be thought of as an internal insurance policy. They allow contractors to cover unexpected costs during the course of a project that might otherwise cause delays as the contractor scrambles to come up with the money, or force cost-cutting in other areas.

Change order

A change order is an amendment to a construction contract that changes or alters the scope of work. Most change orders will alter the timeline, budget, or work required; change orders can result in either an increase or a decrease in the overall price of the contract, but an increase is more common.

Change orders are a common mechanism in the construction industry used to document changes made to the original scope of work; they are essential to ensure that all parties involved are aware of and have signed off on any alterations made to the contract.

Cost-plus / Time & Materials

Cost-plus provide that the customer will pay the contractor for the expenses they incur to complete the project plus a defined fee or a specified percentage markup.

Cost-plus and T&M contracts and similar; however, there is a subtle difference between the two. A T&M contract has contractors add a markup rate to costs, while a cost-plus contract typically provides an agreed-upon fixed fee to generate profit for the contractor that is more rigid in nature.

Guaranteed Maximum Price (GMP)

Guaranteed Maximum Price is a contractual obligation that sets a limit, or cap, on the amount of money a project owner is willing to spend on a project. This is usually included as language within a contract to help a project owner from over-paying and provides a mechanism for managing finances.

This clause is commonly included in T&M contracts to help set a limit on spending for projects that do not have a defined budget. In practice, a GMP clause will set the highest dollar amount that contractors can charge in total for labor, materials, and markup.

Loan

A loan is a sum of money borrowed from a financial institution or lender to be paid back with interest. Loans come in several forms, such as secured or unsecured, commercial, or personal.

Loans are often used to help finance projects, to acquire expensive equipment, or for general business purposes. Contractors in need of a loan should be aware of the SBA Loan Guarantee Program, which works with banks and credit unions that ease the otherwise rigid criteria to help secure loans for small to medium-sized construction companies. Also, be sure to check with your local contractor association for help accessing loans tailored for contracting services.

Lum sump

A lump sum contract specifies a single overall price for an entire scope of work, even if multiple separate items have been quoted. Even though lump-sum payments are typically made all at once, lump-sum contracts can be broken down into . into separate installments.

Percentage of completion vs. Completed contract

Percentage of completion, also known as progress billing, will see invoices submitted at different stages of project completion; at specified time intervals (e.g., monthly) or when a milestone is hit, an invoice is submitted. Completed contract methods, on the other hand, will see a single invoice issued at the end of a project once it’s completed according to the contract.

Retention/Retainage

Retention & retainage mean the same thing; retainage is the amount of money (typically a percentage of each invoice) held back until the project is completed. Owners and GCs collect retainage as a way to ensure that the agreed upon scopes of work are completed to the standards of the contract.

In construction, retainage is typically a fixed percentage of the subcontractor’s bill that is withheld, as collateral, until the job is completed. Similar to lien laws, legal requirements apply and will differ by state; however, maximum retainage amounts will usually range between 5% – 10% in private or commercial jobs.

Unit price contract

Unit pricing is a contract pricing method that assigns a value to each unit of a scope of work. For example, an asphalt contractor might specify that they receive $5 per square foot of asphalt laid.

In construction, unit pricing is sometimes referred to as “measure and pay” pricing. For example, a contractor may use unit pricing to break down the price of a job into a price per square foot. In this example, price per square foot acts as the “unit.”

Continue adding to your financial knowledge

Download our essential guide to job costing and learn how to better understand and control project profitability so you can grow your margins and be more successful