Construction work in progress (WIP), is a necessary accounting process that details the status of a partially completed job and its associated costs. Working in tandem with the percentage of completion method for revenue recognition, WIP reports play a vital role in keeping jobs on budget and invoiced correctly.

For this reason, they’re essential for predicting financial outcomes. This can enable a proactive, rather than reactive, outlook concerning construction project management. This precise tracking of actual costs will help provide an accurate invoice to your customers.

But WIP is so much more than getting paid for construction projects. Creditors and banks use WIP reports to understand the profitability of construction companies. WIP shows whether or not a contractor or company is accurately and effectively estimating and billing for job costs (direct costs) in profitable ways. This can greatly impact a contractor’s ability to secure financing and lines of credit for projects.

However, billing clients the right amount on time doesn’t have to be an overwhelming process. Here’s everything you need to know about WIP and how to better understand your business financials.

What is construction work in progress?

Construction work in progress is a report that summarizes the monetary value of all the work you’ve completed but are yet to invoice. As previously mentioned, WIP will, alongside the percentage of completion method to show how much you’ve spent relative to actual work completed.

In short, this lets you know whether you’re over or under billing. In turn, this also reveals the current profitability of the job. For example, if you’ve estimated that a task will take 10 labor hours to complete, you can use a WIP report to see if that line item is lagging behind or is even ahead of that estimate.

Difference between work in progress and work in process

While similar, it’s worth pointing out the difference between work in process and work in progress. Both are asset accounts for reporting unfinished items. However, work in process is typically used as a production process for manufacturing goods. Work in process is an excellent form of accounting for handling manufacturing costs and optimizing a sluggish production cycle.

However, it’s not the right fit for the nuances of the construction industry. In construction, work in progress is the preferred method for its ability to show a contractor whether they have overbilled or underbilled for any given project. For this reason alone, a WIP report is an essential financial tool that will help bolster any construction company’s balance sheet.

What is the purpose of a WIP report?

WIP reports are great for tracking jobs that are taking longer than expected since you can use to find areas where productivity can improve. This makes WIP especially effective for long-term projects. It can also help business owners understand which projects are the most profitable and which you should escalate.

This system enables better financial statements and allows you to hone in on the precise cost of individual jobs. Providing a valuable opportunity to adjust and augment your bottom line before it’s too late.

How do you calculate work in progress in construction?

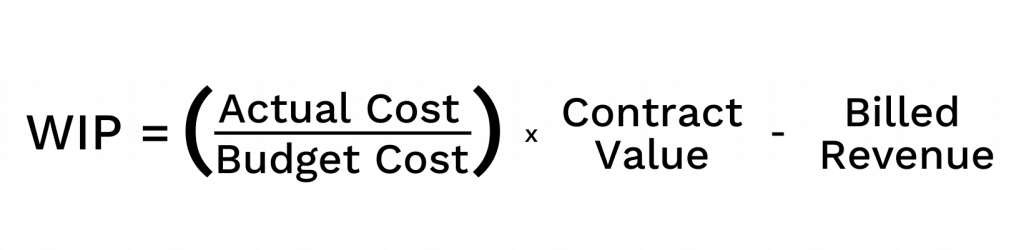

In order to determine a construction project’s work in progress, you’ll need to have the fixed price in your contract (Contract Value) and a Budget Cost on hand.

The fixed price allows us to calculate the percentage of the total project cost against the budget we’ve set for ourselves for a line item or phase of construction.

Additionally, you’ll need the total spent on the budgeted item to date (Actual Cost), as well as the total Billed Revenue on this project to date.

Once you have these numbers readily available, you can begin to calculate construction work in progress with the following WIP formula:

When calculating construction work in progress, the Actual Cost divided by Budget Cost represents Percentage of Completion (POC), so you can see how far along you are.

Once we have the POC, we multiply that value by the Contract Value to get the percentage of the contract you should be invoicing based on how much of your budget you’ve spent. Then, previously Billed Revenue gets subtracted to avoid repeat billing.

The goal is to balance WIP by billing for any remaining work that you’ve completed. By doing so, you’ll remain on track with billing for your project, and your balance sheet should be accurate.

See how Knowify can help you stay on task and on budget, with real-time WIP reports

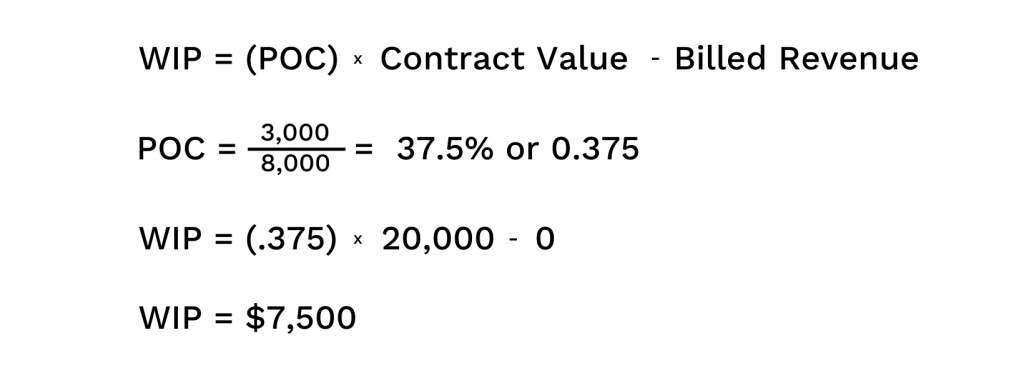

Here’s an example of how to calculate WIP:

One of the line items on a contract is worth $20,000.

Contract Value = $20,000

The budget for the labor portion of that line item is $8,000.

Budget Cost = $8,000

The contractor has not billed for the line item yet.

Billed Revenue = $0

They have already spent $3,000 in labor costs and are currently on schedule.

Actual Cost = $3,000

In this example, the contractor has legally earned $7,500 having completed 37.5% of the work.

Overbilling vs. underbilling

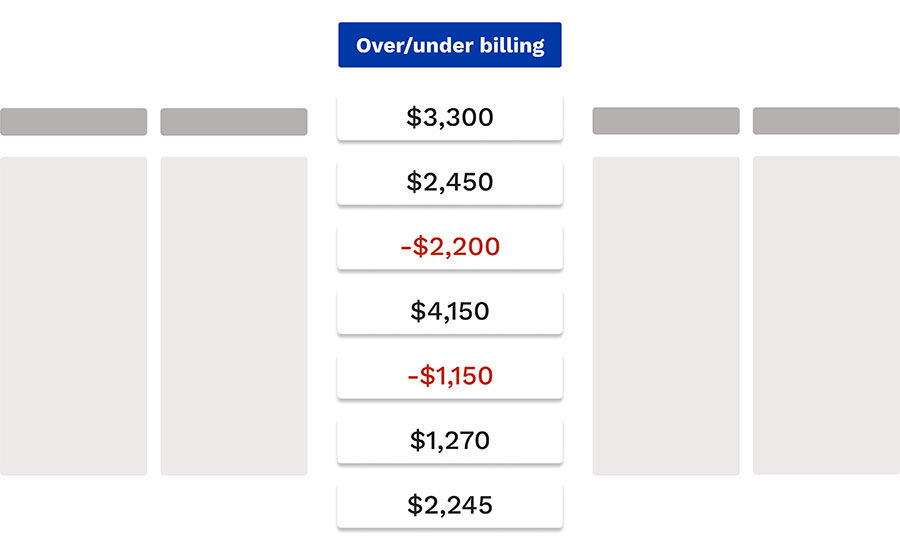

Through these calculations, you can see if you’re over or underbilling. But what does that actually mean? Let’s take a look:

- Overbilling happens when you’ve invoiced for more work than you’ve actually completed. This may cause a boost in cash flow, but it indicates that work is behind schedule and may leave you strapped for cash in later stages of the project if you remain behind schedule.

- Underbilling is the exact opposite scenario in which you have done more work than you’ve invoiced for. This will have an inverse effect putting you in a state of negative cash flow.

As you can see, you can confidently rely on WIP reports to accurately determine where you stand during the entire course of a project. For instance, you are under billing, if you have completed 55% of a project phase but have only billed your customer for 40% of that completed work.

Remember that underbilling will cause a multitude of cashflow issues that could prevent you from procuring the necessary materials needed to keep projects moving forward.

Underbilling can also artificially inflate revenue. This happens because underbilling will show as an asset (not a fixed asset) on your balance sheet because they represent future revenue for work that you’ve already completed.

If you notice you’re underbilling, bring it up to your accountant immediately so you can work together to create a plan for how best to move forward.

On the other hand, if you invoice for 55% of a phase, but you’ve only completed 40% of the work thus far, you’re overbilling. As expected, your accountant will record any overbilled work as a liability in your balance sheet.

This is because you’re still on the hook to complete the work even though you’ve already sent the invoice. The tendency to overbill in an effort to boost cash flow is all too easy. However, you should avoid this temptation as it can overinflate your financial performance.

What should you do if the WIP value is negative or positive?

Now that you have determined whether you have a negative, positive, or zero balance for your WIP value, we can determine the next course of action.

If your WIP value came out zero, congratulations! You’re right where you should be. You don’t need to take any further invoicing actions. Just make sure that all your outstanding vendor invoices get paid by your clients in a timely manner.

A positive WIP value means you’ve completed work that you haven’t invoiced for. You can fix this by invoicing your client the construction work in progress value calculated and having them pay their invoice for that billing period. Make sure to keep track of all invoices related to that work in progress, as you’ll need that to calculate your future Billed Revenue for that line item or phase of work.

Negative WIP values can be trickier to solve for, especially if the value is excessively large. This negative value indicates that you are billing ahead of construction costs for that particular project area. Having your bank account increasing on the surface may look like your business is successful and profitable.

However, consistently over billing on projects carries significant financial risk and could signal cash flow issues that need correcting asap. Over billing is a liability on a balance sheet, and is sometimes referred to as job borrowing. Job borrowing can easily get out of hand and require professional help and significant time to remedy – creating even more expenses for your business.

What does a WIP report look like?

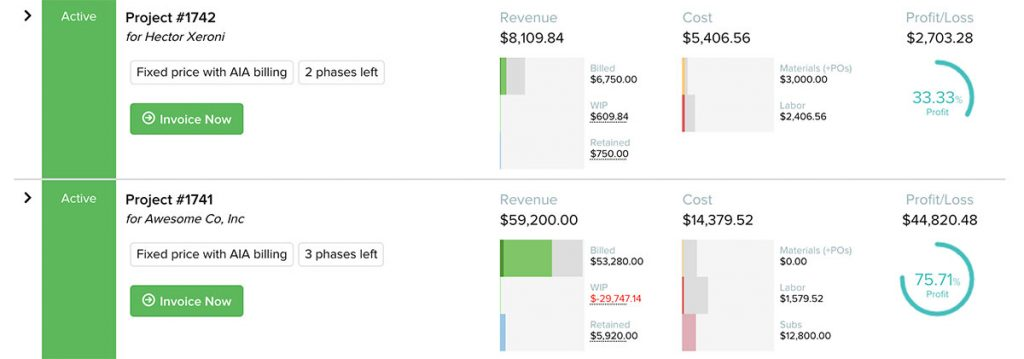

The above is an example of a WIP report within Knowify’s UI. If you’re interested in seeing more schedule a 1-on-1 demo with a Knowify expert today to see what a paperless and efficient WIP process can look like.

Conclusion: make work in progress work for you.

Manually tracking cash flow, using excel spreadsheets, or not having your WIP reports visible within your project can create added stress and room for error–not to mention how time consuming manually tracking all this can be.

In the case of tracking profitability and determining progress made on a particular project, automated reports and visual representations of where you stand financially can make your job far less stressful.

Knowify understands the importance of easy-to-digest information and allows you to maintain an accurate picture of your entire business at any given time.

Never guess again. Track progress & make informed decisions

Schedule a 1-on-1 demo to see how Knowify helps you overcome the quirks of construction invoice timing with comprehensive WIP reporting.