When it comes to job costing vs process costing, contractors may wonder which cost accounting system or costing method is best for their business. Both enable better decision-making and help keep a close eye on the financial health of a project.

However, job costing in construction brings certain advantages that a process costing system does not and vice versa. This article will take a look at some of these key differences.

Difference between job costing and process costing

Job costing is an accounting method for tracking all the associated costs for a specific job. Contractors can use job costing to identify how much money they are making, and will make, on a particular job, and identify precisely where, during the course of a job, they are making or losing money.

You can do this by tracking costs for a job on a granular level. More than just record keeping, job costing is broken down into the following:

Total job cost = materials costs + labor costs (including labor burden) + equipment costs + subcontractor fees + additional miscellaneous costs

Process costing, on the other hand, details the direct costs of identical products or services. It’s best used for manufacturers engaged in mass production of similar goods in which costs can be evenly averaged out.

This method is a more general approach to pricing that divides the total cost by the number of units. As the name suggests, it helps identify the specific cost assigned to each process. Companies that offer the same job or products every time can utilize process costing as a way to save time.

Process costing formula:

Cost per unit of output = total expenses / total number of units produced

Advantages and disadvantages of job costing

Job costing provides invaluable data about your business. When used correctly and consistently, it will serve as a foundation for strengthening and growing your business.

Ask yourself these questions as a contractor–am I actually making money? Am I estimating the correct price? Am I scheduling the right crews for my jobs? Effective job costing can address most of these issues and other friction points that contractors face.

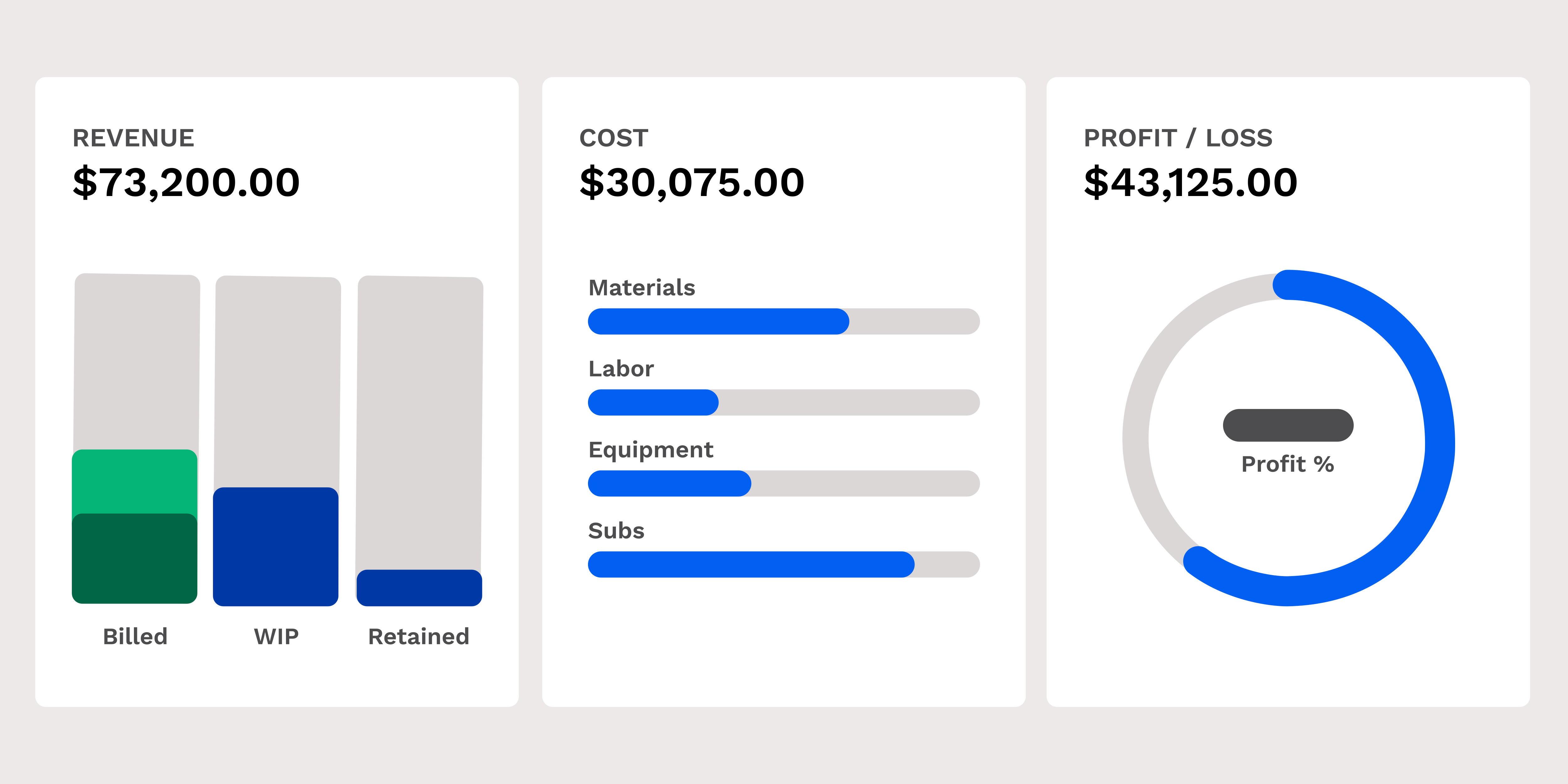

Collecting and utilizing information on the profitability of jobs on an individual basis is where job costing shines. It can calculate work in progress, also known as WIP, total revenue and enables better tracking of the costs and profitability of change orders.

Keeping track of all job costing data will eliminate assumptions and provide real actionable data that you can use to avoid overspending during an individual job or while planning an upcoming job. Meaning you can make better decisions on most aspects of your business with cleaner financial statements.

The limitations of job costing depend on the level of time and resources that you are willing to put into it. At the most basic level, capturing costs at the job level will let you know how profitable you are; you will know what the numbers are, but you won’t be able to determine why you made or lost money.

You won’t be able to understand why you went over or under budget unless you scale your job costing efforts by taking the time to get more granular with budgeting, tracking, and planning.

To get the full story of job-level profitability, contractors will need to develop a comprehensive budget, break out jobs into phases, and track costs for every phase. This will take time, and more planning upfront, but doing so will reveal invaluable information regarding profitability.

Knowing the how and why of each job will give contractors the steps they need to ensure each job is a profitable one.

To help contractors get started, we have put together a comprehensive guide on job costing that gives contractors everything they need to improve job-level profitability.

Job costing in construction

Taking a look at an example, let’s say a contractor budgeted a total of $4,400 for a job. With $3,000 in labor, $1,000 in direct materials and finally $400 in equipment.

By using a job costing system we learn that the time actually spent by the employees, the actual labor cost, was $3,200 and $900 was paid to local vendors for materials. Equipment rentals incurred an actual cost of $420. The complete job cost in this example comes out to be $4,520 which is $120 over the estimated $4,400.

Once you know your budgeted cost, the next step is to determine how many materials and hours were actually used.

Job costing requires reliable and accurate information that you can use to make better decisions. To do this, you need a robust and intuitive software like Knowify to keep track of it all. Utilizing construction management software will allow contractors to drill down and identify where costs are exceeding estimates.

Advantages and disadvantages of process costing

Process costing is a simple and streamlined approach to tracking costs. Because of this straightforward approach, this method can make it easier to make changes to processes and can quickly help target where costs are exceeding budget.

In addition, it is a standardized process that can benefit contractors primarily working with identical services or products.

However, the simplicity of process costing systems is a double-edged sword. The lack of detail and specificity can create costly errors, which can drastically inflate or under-report the actual costs of a job.

For this reason, any job that is unique or custom will benefit significantly from job costing, which is why contractors seldom use process costing.

Process costing in construction

There are three approaches to process costing:

- Standard

- Weighted average

- First in, first out

Under standard costing, a contractor would estimate how much they typically spend when conducting a service. From there, they can scale that number to determine how much they would spend in an entire year and incorporate that into an annual budget.

The weighted average approach will compute the value of services and cost of goods sold. To do this, you would group all the costs of conducting a service and assign those costs to the total number of services provided. From there, you can apply an average cost per service.

The third approach is known as first in, first out. With this method, costs are assigned to services in the order that they are completed. This method creates layers of process costs. One for services started but not completed from the previous period and one for services that have just begun.

While contractors can use processing costing, we strongly advise using job costing instead. Job costing, while more involved, will give contractors clarity, precision, and information that process costing will not.

In addition, job costing better fits the nature of the construction industry, as it allows for detailed analyses on a per-job basis.

How Knowify helps simplify job costing

Using job costing vs. process costing will depend on the needs and circumstances of your business. With that said, most contractors will reap the benefits of a job costing system.

Job costing is one of the most important systems you can incorporate into your business, and with modern tools and technology, it’s now easier than ever to collect the data needed for accurate and actionable job costing.

If you’re looking to boost profitability and efficiency within your company, Knowify offers a powerful job costing system that can help track costs in real-time. This is a game changer for cost reduction on each and every job.

Learn which kinds of jobs make you the most money, or where you might be consistently underbidding by booking a 30-minute demo today!