What is a mechanics lien?

In the construction industry a mechanics lien (also known as a construction lien or contractors lien) happens when a contractor performs work that will permanently improve a property, but does not receive payment for the completed work. The unpaid contractor can place a lien on the property which acts as a security interest (or collateral) on the property until payment is delivered.

In other words a mechanics lien is a legal claim for unpaid construction work and means that the owner of the property owes a contractor money for work performed. This allows the opportunity for a contractor to place a lien (which acts as collateral) on the property to put pressure on the owner to deliver payment.

A lien works to guarantee an obligation, meaning that property owners can’t ignore it legally. Once placed, a mechanics lien is a cloud that hangs over real estate, which makes it extremely difficult to sell or transfer ownership of a property title until the lien is lifted.

Despite their nefarious reputation, construction liens are a natural part of the contracting world. In certain circumstances, they’re a useful piece of documentation for ensuring fair treatment and payment.

However, they are often misunderstood, feared, or misused by contractors. This article will look to break down how a lien works, when to use one, and how to safeguard your lien rights as a contractor.

How to file a lien for unpaid work (how mechanic’s liens work)

There is no standardized mechanics lien claim process as each state has its own laws, regulations, and procedures. Because of this, contractors need to study their state’s lien laws; understanding your rights is vital to protecting yourself should you need the law on your side. More important than that is understanding how to exercise your rights. You can typically find state lien laws through the website of your state.

With that said, one universal aspect of a mechanics lien is that they are viewable by the public. Anyone who wishes to view property information will see active liens against a property. This is a vital component of a lien. This puts significant pressure on lienholders as any lien will provoke the ire of investors, potential buyers, or business partners.

While the process for filing a lien is subject to the state that is filed, a basic process may look like the following:

- Notice of intent: A notice is filed and sent to the owner with the specified amount owed, the GC that hired you, and a project description. This works as a warning, with the hope that the issue is resolved before a lien actually has to be filed.

- Preparation of the lien: If final payment is not resolved, the lien must be prepared for filing. This may require a notarized statement to accompany other documents, such as a breakdown of the amount owed, including interest, fees, and additional costs. When preparing the lien, it’s vital to double-check accuracy. Some states will penalize filers who miscalculate the amount owed to them. If it’s deemed you are intentionally dishonest, you may have to pay all legal and attorney’s fees for the opposing party.

- File and serve the lien: Once the lien is prepared, it must be filed through the appropriate county clerk’s office within the required period of time. From here, the lien must be served to the owner, contractor, and all relevant stakeholders.

- Post filing: After filing the lien, many states will require an acknowledgment of satisfaction if payment is finally received following the lien. If payment is not received, an enforcement period will begin in which the owner must resolve payment issues within a specified time period.

Why file a mechanic’s lien?

Let’s start with a real world example. Say a plumber does a job on a property that is done correctly, up to code, on time, and in accordance with the construction contract. The general contractor that contracted the plumber is happy with the job, but cannot pay the plumber as the GC has not yet been paid by the property owner.

By leveraging the lien process the plumber, as a subcontractor, can help kick-start the payment process and place a sense of urgency on the matter as this is a breach of contract. The further down the payment chain, the harder it becomes to have a voice or make your concerns heard. Through mechanics liens a subcontractor or laborer can ensure communication and visibility.

The importance of liens has been further showcased as a result of the COIVD-19 and continuing instability due to world events. According to recent studies only around half of all construction companies are paid in full on a project and 54% are unable to pay bills on time as a result of late payments.

From these numbers it’s easy to see why contractors need mechanisms in place to protect their rights and ensure payment for honest work. It also highlights the importance of knowing your numbers, using data effectively, and planning efficiently to give your business a leg up on financial issues.

It should also be noted that a lien can be filed even if you don’t plan or intend to follow through with it. Filing a lien does not mean there is an issue, it just means the contractor is trying to protect themselves and only around 11% of contractors do so on every project.

A lien will dramatically increase the chances of getting paid should the worst case scenario happen in which the property owner declares bankruptcy. In this case, the property will be sold and a portion of the proceeds will go towards settling the debt owed to the unpaid contractor.

Few contractors take advantage of their liens rights due to fear of damaging the relationship with a customer. It’s been estimated that as much as one third of contractors would rather preserve a relationship with a customer who has not paid them over filing a lien and protect their money.

With that said, filing a lien is a very serious step and should not be taken lightly. A contractor will need to first look toward talking through a dispute or payment and see if an agreement can be made. Most disputes are caused by communication issues and not due to bad intent. However, if a diplomatic resolution cannot be found a lien should be used as a last resort to get paid.

Who can file a mechanic’s lien?

Any contractor or laborer who has provided a permanent improvement to the property has lien rights if they are not paid and can file a mechanic’s lien form. It’s important to note that if a trade requires licensure, any unlicensed contractor will not have lien rights and cannot place a lien on a property.

In addition, a mechanics lien will only apply to private properties. If working on a public property, a bond claim will most likely be used instead of a lien.

As a lien claimant, it’s crucial that you know your state’s mechanic’s lien laws. Each state has different timelines, requirements, and procedures. In addition, the process and rules will vary depending on the state, and role that you have in the construction project.

General contractors, subcontractors, suppliers, and laborers all have different rules and requirements in regards to filing and handling liens. So it’s important to know your state’s requirements before staring construction projects.

How to file a mechanic’s lien

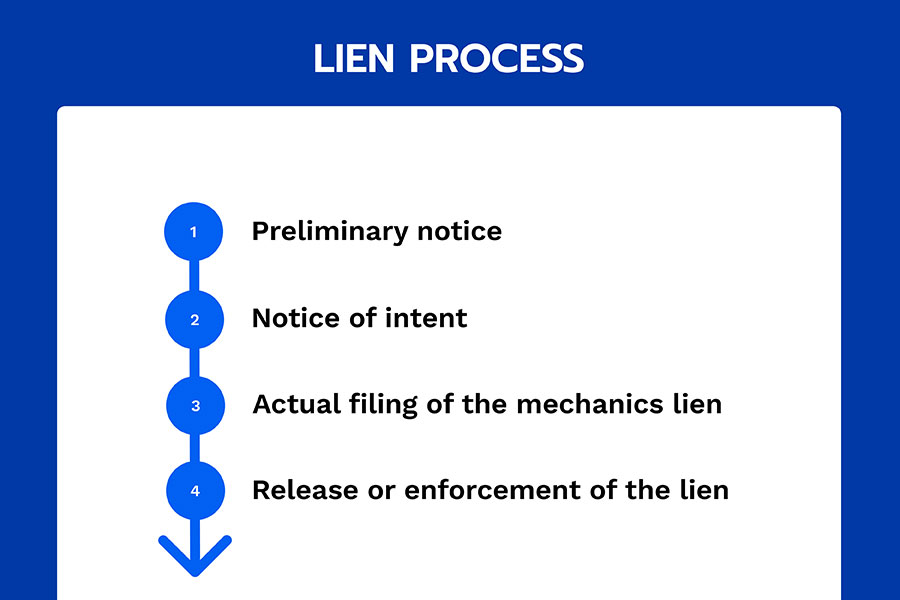

The lien process is usually broken down into 4 steps:

It is considered best practice to provide a preliminary notice at the start of a project, even if your state does not require it. This will ensure you are protected moving forward and will improve communication and visibility.

The lien process is very time sensitive and should be followed with diligence and alertness. It’s critical that contractors do not miss any steps and hit time sensitive deadlines to ensure their rights are protected. In any case the lien process will need to start with filing a lien with the county recorder’s office in the county where the work is being performed.

In Colorado state law for example, contractors will have 4 months after providing the last service or material to issue a mechanics lien. From there they will need to provide a notice of intent to lien 10 days before issuing the lien.

Many states require a notice of intent and even if your state does not require a notice, it’s regarded as best practice to issue a notice as it facilitates communication and may provide enough of a warning to the owner to expedite final payment.

Finally a contractor will have 6 months after completion of services to file an action to enforce a mechanics lien.

Going further with Colorado as an example the following information is required in the lien:

- Property owner information

- Mechanic’s lien claimant information / Prime contractors information

- Description of the property

- Amount claimed

- Proof that a written notice of intent was served, often in the form of an affidavit.

- The lien must be notarized to be valid

It’s a common mistake for contractors to provide incorrect or insufficient information with their lien. It’s crucial to include as much detailed information as possible providing a comprehensive description of the property, work completed, and amount owed. Most important is hitting deadlines. Even an exhaustive lien will fail if deadlines are not met.

Once filed property owners can deliver payment and then subsequently issue a lien waiver or release of lien which essentially works as a receipt that the job was completed and payment was delivered satisfying the agreement. The contractor will then submit an acknowledgement that payment was received and that the lien has been lifted. In this case everyone goes home happy.

If you still haven’t received payment after you’ve issued a lien, it can then be legally enforced. Which can result in legal proceedings, court action, and even the forced foreclosure and sale of the property. If enforcing a lien it is recommended to seek legal counsel.

Key takeaways

- Communication is key. A lien is worth avoiding if possible, and all efforts should go towards negotiating and coming to an agreement with all relevant parties.

- Only consider filing a lien if you are owed money for work completed, and all other measures have failed. Don’t be afraid to file preliminary liens, knowing that you have rights to protect your work.

- Ensure you follow your state’s rules exactly as they are stated to ensure your lien will survive and can be enforced.

- Always seek legal advice from a trusted construction attorney before filing a lien.

From an overwhelming amount of documents to bills and deadlines, contractors have a lot on their plates. Luckily, Knowify’s business management software is built to help contractors execute projects that drive growth.

We take the headache out of financial reporting and show you the impact every job has on your business so you know exactly which projects to focus on.

We’re the single source of truth for every project, eliminating all the manual data entry and expense tracking that keeps you tied up behind your desk. Schedule a demo and start growing your business today!