Despite the precariousness of the past five years or so, the construction industry has proven, as it often does, to be quite resilient. Not only has it weathered the storm of COVID-19, it found a way to reach an all-time high in spending, hitting $1.57 trillion in 2021. That is a 12% increase from pre-pandemic levels!

However, many contractors are still experiencing cash flow issues due to slow or incomplete payments. In truth, only 12% of construction business owners claim to always receive on-time payments. And less than half of all construction companies that offer Net30 payment terms actually receive payment within 30 days.

Despite a boom in spending, the construction industry faces inflation, supply chain issues, and rising costs for materials like steel and lumber. A lot of this is outside your control as a single contractor or construction business owner. But focusing on what you can control, especially when it comes to your invoicing and billing operations, can make all the difference. Fortunately, there are several steps you can take to optimize your invoicing system to secure faster payments from your clients.

A well-structured billing process won’t prevent material costs from rising, but it can help you prevent confusion and the preventable errors that lead to invoicing issues. Focusing on your billing process is the shortest ticket to accurate and on-time payments from your clients.

This is critical because getting paid what you’re owed (otherwise known as accounts receivable) in a timely manner is critical to maintaining healthy cash flow. Delayed invoicing and late payments are at the top of the list of issues that disrupt cash flow and prevent construction businesses from reaching long-term sustainability.

Invoices are a critical link in the billing process. In this article, we’ll give you everything you need to know to understand the elements of a construction invoice for a more professional and organized invoicing process.

What is a construction invoice?

An invoice is an agreement between a buyer and a seller that declares that a buyer owes money to a seller in exchange for goods or services. An invoice will detail the exact amount owed to the seller, with an itemized list of everything the buyer is purchasing. In addition, an invoice will list the terms and conditions of the transaction (e.g., due dates, net30 terms, etc.).

In a construction or specialty trade setting, an invoice is a request for payment for materials sold or work performed. Subsequently, this will generate an account receivable on your chart of accounts. All combined, an invoice will serve as a written transaction record that identifies payment obligations and terms.

The construction invoicing process is key for construction businesses that are prioritizing financial stability. Beyond the obvious financial impacts, professional invoices will help set clear lines of communication between you and your clients. A well-oiled invoicing system will help you to cement yourself as a legitimate construction business.

What are the different types of construction invoices?

There is no universal invoicing method in the construction industry. Each job–each business–will rely on the invoicing method that best suits their needs and the specifics of a job. For example, a large construction project spanning a few years will likely use a progress billing method. In contrast, a smaller maintenance job may use a single lump-sum invoice at the end of the job.

Below we’ll look at three common construction invoicing methods and how each affects the invoicing process.

Construction invoicing methods:

- Progress billing & Milestone billing

- Cost plus (T&M)

- Lump sum

Progress billing (percentage of completion)

Progress billing (also called percentage of completion) is a tried and true invoicing method. You can use this method on construction jobs both large and small–although most large projects will require the use of percentage of completion billing system.

You can and should use this method on fixed-price contracts. In this case, the contract will set a fixed price, but the invoicing method used for receiving payment will utilize progress billing.

For example, suppose you’ve submitted (and the customer accepted) a fixed-price quote. In that case, they’ll likely bill in increments based on specific timing increments (milestones) or based on how far along you are on the job (percentage of completion) at the end of each month.

To see how this works, imagine you quote a job for $50,000 that’ll bill at the end of each month based on the percentage of completion. At the end of the first month, you’ve completed 15% of the job, meaning you’ll send an invoice for 15% of the total contract amount–i.e., $7,500.00.

Another form of progress billing is milestone billing. When it comes to invoicing, progress billing, and milestone billing are similar yet distinct. Progress billing will invoice according to the amount of work completed, while milestone payments are dependent upon predetermined tasks or achievements.

For example, progress billing will bill at a regular cadence based on how much work you’ve actually completed. While a milestone invoice will only trigger once you’ve completed a significant task in the project, such as the completion of a foundation. Ultimately, the choice of payment structure is contingent on the needs of the job, contractor, and stakeholder involved.

Keeping track of overall job progress and the status of each task requires diligent tracking and tons of paperwork. For this reason, many contractors choose to use the payment forms set forth by the American Institute of Architects (AIA).

AIA-style billing utilizes pay applications–i.e., specific documents used to sort and track progress payments. AIA pay apps are by no means required, but they work well as a standardized payment process that can greatly improve the organization and invoice tracking of your progress payments.

Cost plus (T&M)

Using cost-plus, you’ll get paid for all expenses you’ve incurred plus a separate percentage or set fee. A cost-plus invoice will contain all costs you’ve incurred on the project (i.e., materials, labor, equipment, and subcontractor costs) plus this fee.

Some project owners may place a Guaranteed Maximum Price clause on cost-plus agreements. This clause will cap the amount of project costs the owner is willing to spend.

Time & Materials billing (T&M) is a slightly different version of cost-plus invoicing. Under this invoicing method, you’ll provide your client with an hourly rate for labor accompanied by an estimate for project timelines. In other words, here’s what you’re charging, and here’s how long you think it will take to complete it.

Accordingly, it’s best to negotiate for a T&M contract that allows you to place a markup on material costs–this is the cost-plus aspect of a T&M contract. Once you’ve solidified your markup percentages, material costs are generally passed directly to the client for payment, and you can charge labor costs on an hourly basis.

Lump-sum

Lump-sum invoicing will see all funds delivered in one single installment. Under this method, you’ll set a fixed-price for all of your services for the entire project.

With an accurate estimate and budget in hand (based on the scope of work) you can put together a proposal. Once signed, the contract price is set in stone–even if you spend more than you budgeted for, the client is still only obligated to pay the original agreed-upon price stated in the contract. Under this method, your client will administer payments in full at the start or end of the project.

How to create construction invoices?

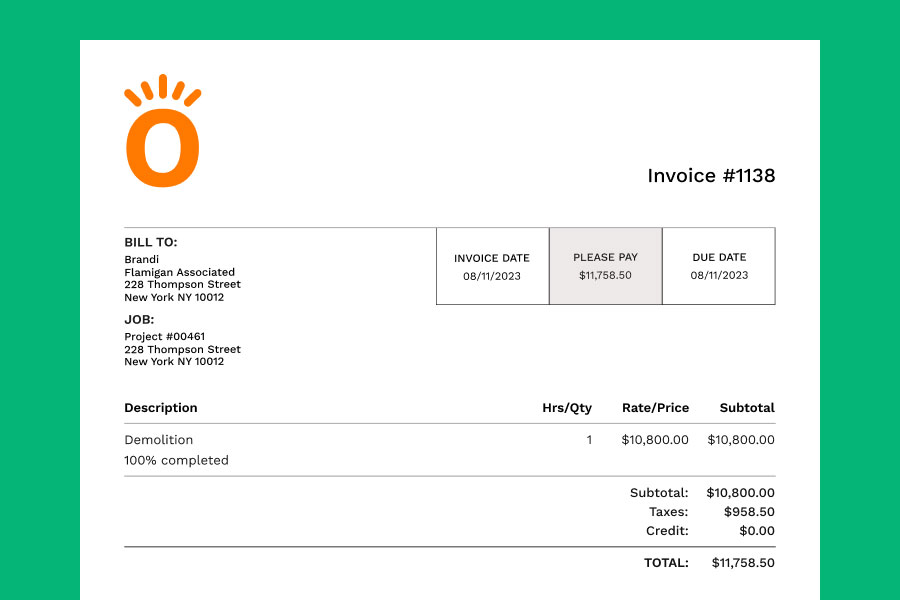

Construction invoice template example

There are many free construction invoice templates out there to choose from, but for the best results, we recommend using a customized and branded invoice through construction management software to create invoices.

What’s included in an invoice for construction?

Your specific invoices will change depending on the contract type and needs of the project. Below is a breakdown of the core invoicing components for all three invoicing methods previously discussed:

☐ Invoice date

☐ Invoice number

☐ Customer details (name, address, etc.)

☐ Brief line item descriptions of the services or tasks provided

☐ Quantity of services (labor hours or units)

☐ Unit cost of services if applicable

☐ Line item total of services

☐ Total amount of invoice

☐ Payment terms (i.e., Net30 or Net15)

☐ Due date for payment

☐ Total value of work to date (if applicable)

☐ List of work completed, percentage completion or relevant milestones reached (if progress billing)

☐ Late fee terms

☐ Payment options (e.g., checks, credit cards, bank transfers, etc.

☐ Contact information for all relevant parties

☐ Any relevant change orders

☐ Any costs retained by the client until completion (aka “retainage”)

Basic business information

Use this section to identify who the relevant parties are for the particular invoice in question. This tells anyone looking at it who the buyer and seller are in addition to project information such as location, project number, business details, etc.

Basic information to include:

- Business name and address

- Client name and address

- Project location/address

Invoice number & date

An invoice number is a unique code applied to each invoice for tracking and record-keeping purposes. In addition, you should display the date you issued the invoice near the invoice number.

Total amount due

The outstanding dollar amount due for this particular invoice.

Payment due date

The date on which the buyer must submit payment for the services outlined in the invoice.

An itemized list of work performed

This will include a description of each phase, task, or service that you are billing for. The exact list will, of course, depend on the contract in place.

For example, a percentage of completion invoice will provide specific percentages for each line item or the exact percentage of work for the entire contract or phase that you’re billing for.

This itemized list should also indicate the amount of labor hours used, the rate you’re charging, and a breakdown of all totals–i.e., subtotals and grand totals taking into account taxes and/or credit.

Identifying and separating tax totals is a vital aspect of invoicing that you should never ignore. Always double-check to ensure your invoices correctly apply and display tax amounts.

Comments/Special instructions

Use this section to list any additional notes or instructions you have regarding the terms, payment, or services provided.

Easily create invoices with Knowify

Knowify tracks your contract terms, the work you’ve done, and the amount you’ve already billed to auto-fill your invoices, and tell you when to send your next one.

How to send invoices to clients?

Before sending an invoice for construction, make certain that you run through the following steps:

- All information is accurate and up-to-date

- You’ve included your contact information and your client’s contact information

- All services provided are listed as line items with brief descriptions

- All corresponding prices match the correct totals for the work completed

- Tax, discounts, or credit information has been properly applied and displayed

- The invoice is easy to read with clear headings and sections

- The invoice is accurately dated with clear payment terms that are easy to understand

You’ll trigger the invoice process once you’ve met specific conditions laid out in the contract. For example, if using progress billing, the invoicing process will commence at the end of each month, or once you’ve hit a project milestone. Subsequently, you’ll prepare an invoice requesting payment from the client with all relevant details.

Now how do you get it to the client? In times of yore, you would mail or hand deliver an invoice. Today, however, electronic invoices sent via email are the way to go. Digital invoices are a fast and easy way to get invoices into the hands of your clients–helping you get paid faster.

In addition, electronic invoicing helps keep everything organized since you can monitor and track the status of an invoice, send reminders, and store invoices in a secure database rather than in an old dusty filing cabinet.

How to manage client communication

Switching to an online invoicing system will do wonders for your customer relationships. It makes accessing, reviewing, and submitting payments easy for your clients. If they do have comments, you must respond quickly.

If you made any errors, it’s vital that you address those and resubmit the invoice to avoid any cash flow issues. Additionally, if they require clarification, kindly provide it and use that feedback to improve the clarity of your next invoice.

Even the most prudent of clients will be slow to pay invoices from time to time. When this happens, you should take the initiative and provide professional reminders. Tools like Knowify allow you to track the invoice status to see when the invoice is viewed and signed by the client. You can also send automated payment reminders to clients in a way that is not too pushy but still effective at pushing for payment.

We understand that slow payments are a constant source of frustration in the construction industry. But it’s important to remember to keep your cool and stay professional at all times. Focus on what you can control: be quick to respond, stick to the facts, and stay diligent.

How to deal with late payments

The best way to deal with late payments is to do everything you can to avoid them altogether. Take steps to ensure you’re incentivizing and enabling clients to make prompt payments.

- Include online payments links on every construction invoice

- Include clear payment instructions

- Consistently follow up with clients who are yet to make payments

- Ensure you’re sending invoices at the correct times (nothing looks worse than a late invoice that your client or GC rejects on the spot)

- Negotiate payment terms for Net30 or lower

- Request a deposit or interest rates for late invoices (i.e., late fees)

- Include late fees on our

You should always take the steps above, but even then it’s a fact of life that some clients will still miss payments. If a client continues to leave you in the dust and fails to respond to your reminders you can file a mechanics lien as a last resort. This is a drastic measure that you should put plenty of consideration into before enacting.

Always consult a lawyer and your accountant before filing a lien to ensure it’s warranted and you stand a chance of actually recouping costs.

Invoicing with Knowify

In our increasingly digital world, it’s no surprise that online payments have become commonplace. Checkbooks have become a relic of the past. But, not so long ago, setting up the infrastructure needed to make electronic payments possible was challenging. Fortunately, with tools like Knowify, this is no longer the case.

Knowify has partnered with leading payment companies to offer electronic payments directly to your Knowify account. Setup and authorization is such a breeze, that new Knowify users are typically approved and ready to receive credit card payments within a week.

- Send electronic payment links with any of your invoices

- Collect credit card and e-check/ACH payments

- Accelerate your cash collection cycle

Streamline your construction business, stay organized, and save time with Knowify Base. Create and manage proposals, contracts, change orders, and invoices, all in one place, for just $48/mo.