PaySimple integration

Keeping your cashflow under control is key to running a healthy and profitable contracting business. We know how collecting from your customers is not always easy; that’s why we’ve partnered with PaySimple to bring you the power and convenience of electronic payments inside Knowify.

Processing fees

With this unique partnership, you can have access to the most competitive rates in the market.

| Credit card | |

|---|---|

| Per transaction | 2.39% +$0.32 |

| Non-qualified surcharge | 1.20% |

| Batch fee | $0.39 |

| Chargeback fee | $30 |

| Monthly PCI compliance fee | $5.95 |

| E-Check (ACH) | |

|---|---|

| Per transaction | $0.59 |

| Batch fee | $0.29 |

| Non-sufficient funds | $2.50 |

| High ticket surcharge | +0.25% |

| Chargeback fee | $25 |

FAQs

Here you can find most frequently asked questions about our integration with PaySimple.

What do these numbers mean?

For credit cards, you can collect an electronic payment for as little as 39¢ + 2.39% when your customer pays with a qualified card (most consumer cards are qualified cards, American Express being the main exception). If your customer pays with a business card, you will likely be charged 29¢ + 3.59%.

For e-checks (aka ACH), the fee is usually 55¢, unless the transaction is for more than $5,000 or something goes wrong (insufficient funds).

You will also be assessed a 29¢ daily processing (“batch”) fee for any day on which a payment is processed. This fee will be the same regardless of whether you process 1 transaction or 100 transactions that day.

Why do we have qualified and non-qualified cards?

It’s a matter of risk for the payment processor. Classic consumer VISA and Mastercard cards get better rates because they have lower rates of chargebacks, fraud, etc.

How do I collect the electronic payment from my customer?

There are 2 ways:

a) If you send the invoice to the customer from Knowify, you can include a link for the customer to pay online.

b) If you already have the customer payment information, you can run the payment from the invoice details page in Knowify.

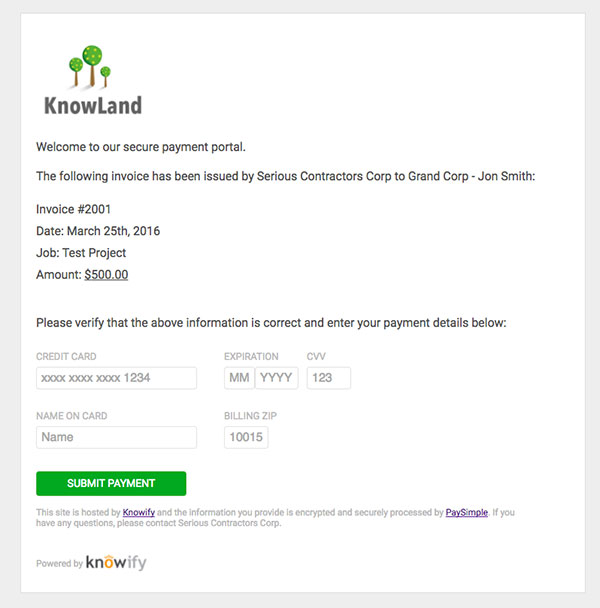

What happens when the customer clicks the link to pay?

The customer will be presented with the page below, with your business information and logo. He will also have access to the invoice information and will be able to select the payment method.

What if I don’t want to accept a certain form of payment?

Easy. When you send the link to the customer, you can decide whether you want to accept any credit card, any credit card but AMEX, or e-checks.

Why should I give up some revenue in my job to collect electronic payments?

Well, each business is different, but most can benefit from the following:

- Get paid faster. Time is of the essence when running a contracting business. You have expenses to pay and you need to keep the revenue stream in sync.

- Make the customer’s payment process easier. Customers expect to be able to pay electronically and they appreciate the convenience. Happy customers are more likely to bring more business in the future.

- Look more professional. Start the job by sending the proposal for e-signature and complete it by emailing the invoice to the client with a payment link. Seamless, paperless, and efficient. Make your business shine and impress your customers.

- Streamline the collection process. No more reconciling your bank account statement with your outstanding payments. Save hours in the office and avoid mistakes. When the customer pays online, Knowify sends a confirmation message to both you and the customer. You also get an email to access the paid invoice in Knowify. Additionally, if you are connected to QuickBooks, Knowify automatically syncs the payment with QuickBooks and marks the invoice as paid via PaySimple.

- Avoid the risk of holding the customer payment details. By taking electronic payments via PaySimple, you don’t have to worry about keeping the payment details safe. PaySimple takes care of everything so that you can have the peace of mind you need to focus on what really matters to your business.

Ready to start processing electronic / ACH payments?

Contact us at support@knowify.com to get started or contact PaySimple at 800-466-0992 or sales@paysimple.com and tell them you are a Knowify user to get access to this exclusive opportunity.